Almost 1.5 years have been passed , since the last report by Hindenburg research on Adani Group and now today in an blog article they posted about Documents Reveal regarding , ” SEBI’s chairperson stakes in obscure offshore entities ” used for ” Adani money siphoning scandal “.

What happened 1.5 years back ?

You can refer to our older post for more information and then read this article but in summary. About 18 months ago Hindenburg posted a report on Adani , as how he allegedly inflated share prices of his company . But The Supreme Court of India had given clean chit after SEBI’s report on the situation.

On june 27 , 2024 SEBI sends a ‘ show cause’ notice to Hindeburg Research regarding the matter . It (the notice) did not contain any factual errors against the reports (by Hindenburg research) but said that the so-called disclosure should have been more robust.

The SEBI’s notice also claimed that the HIndenburg’s last year’s reports were “reckless” .

“IPE Plus Fund” – a Mauritius fund set up by an Adani Director

“IPE Plus Fund” is a small offshore firm setup by one of Adan’s Directors through IIFL , which is used by Vinod Adani (brother of Gautam Adani) to invest in Indian market with funds allegedly siphoned from over invoicing of Power Equipment to the Adani Group.

After a series of investigations by ” Adani Watch” in December 2023 , it came to notice how a web of offshore entities , controlled under Vinod Adani were recipient of these over invoicing/s of Power Equipment.

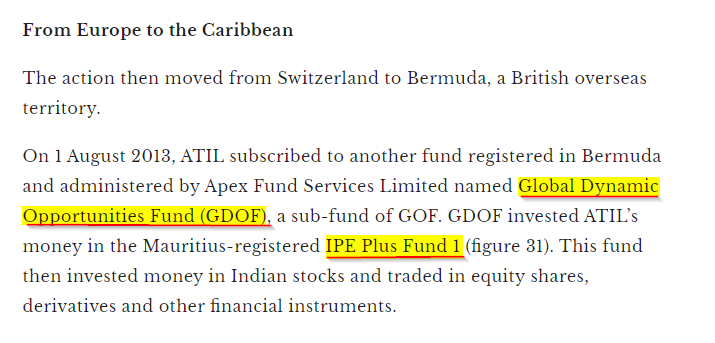

Vinod Adani controlled comapny “IPE plus fund ” invested in “Global Dynamic Opportunities Fund” in Bermuda , a british overseas territory and also a tax heaven , which then invested in “IPE Plus Fund 1” , a Mauritius based Fund , another tax heaven.

A separate investigation by ” Financial Times “ showed how the parent fund of GDOF was used by two Adani associates to ” to amass and trade large positions in shares of the Adani Group”.

These nested funds , were managed by Indian Infoline (“IIFL”), now 360-one . IIFL has a long history of being in , one of the biggest scandals of Germany , Wirecard scandal.

Whistleblower’s Document Reveal

Whistleblower’s Document Reveal shows how the ” Madhabi Buch ” (current chairperson of SEBI) and her husband “Dhaval Buch” had stakes in these offshore funds used in Adani’s money siphoning scandal.

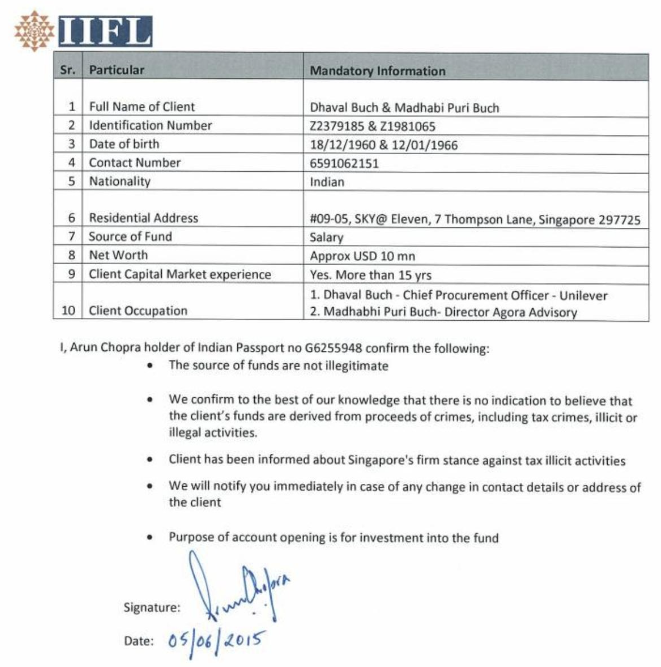

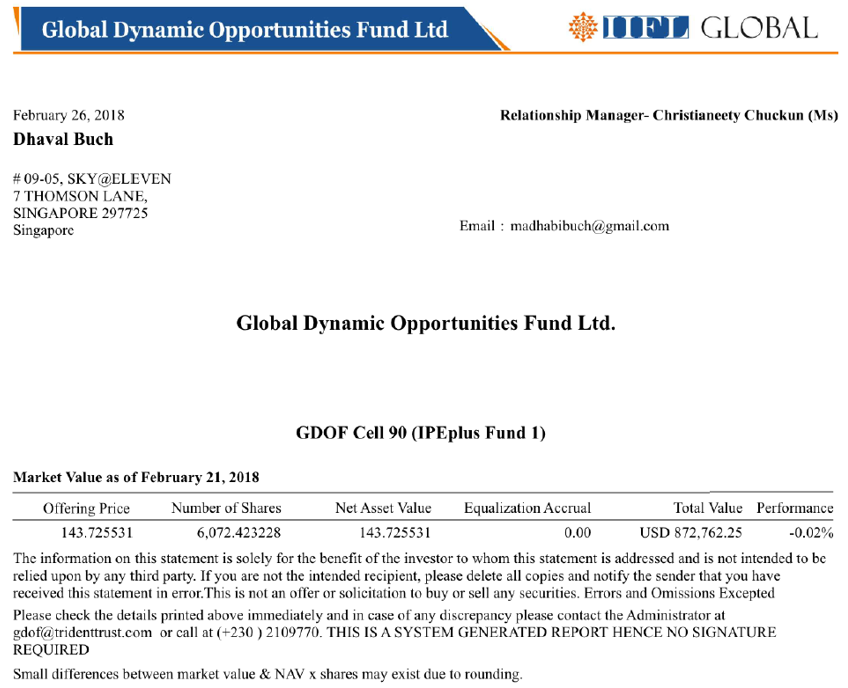

As per whistleblower’s documents , the chairperson and her husband first opened their accounts with ” IPE Plus Fund 1 ” on June 5th, 2015 in Singapore.

A declaration of funds signed by a principal at IIFL, shows the source of Funds as Salary and couple’s net worth to be $10 mil.

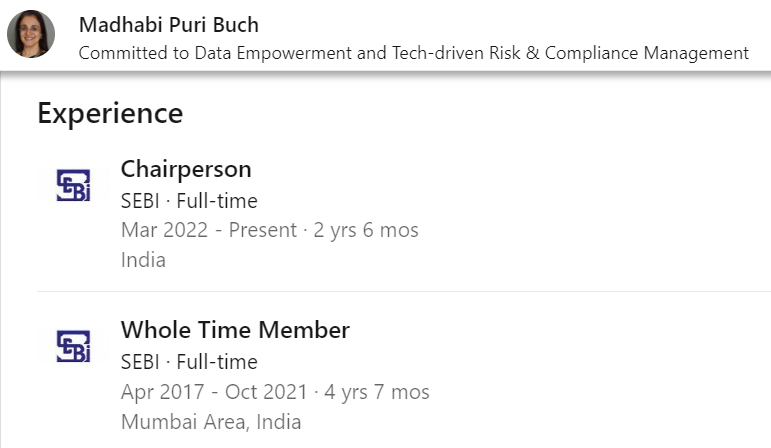

According to Madhavi Buch’s LinkedIn Profile she was appointed as full time member of SEBI .

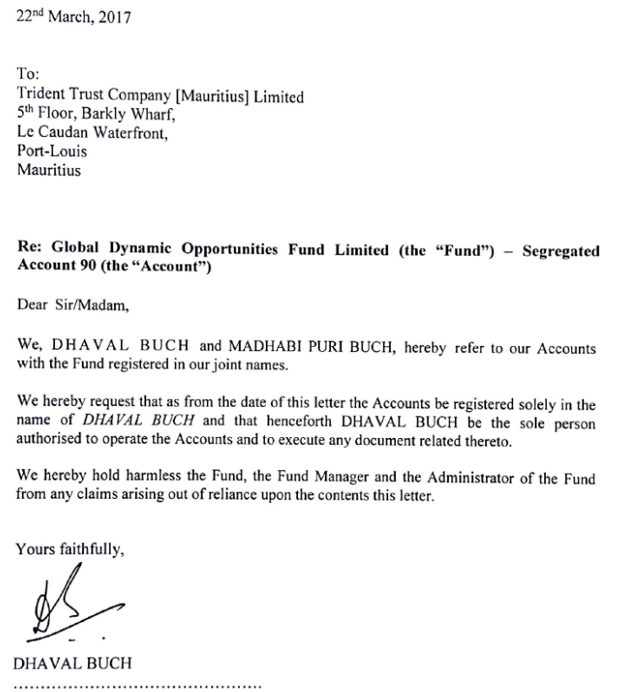

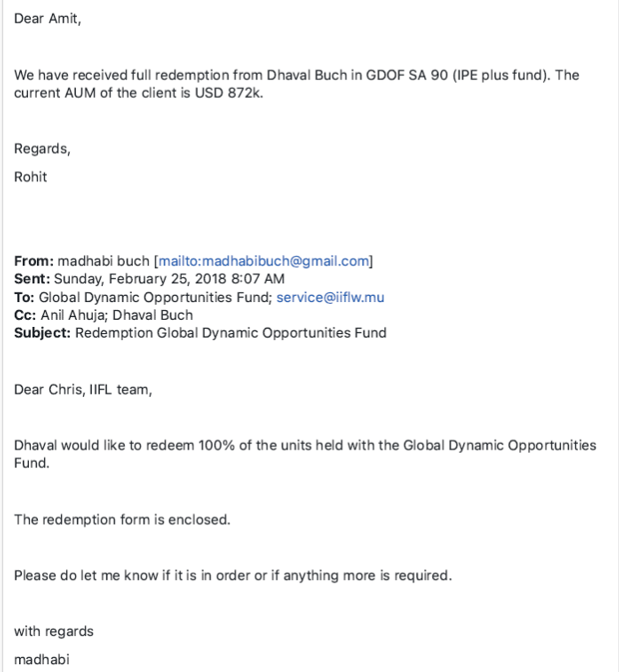

On march 22nd , 2017 just weeks ahead of her becoming full time member, Dhaval Buch husband of the chairperson requested in an email to Mauritius fund Administrator , Trident Trust , “be the sole person authorised to operate the Accounts”, seemingly moving the assets out of his wife’s name ahead of the politically sensitive appointment.

In a later account statement addresses to the chairperson , shows full details of structure , “GDOF cell 90 (IPE plus fund 1) “.

Later on February 25th , 2018 , after her becoming full time member at SEBI , she wrote to India Infoline using her private Gmail account , doing her business using her husband’s name , to redeem the units in the fund.

Madhabi Buch and her husband had stakes in a multi-layered offshore fund structure with miniscule assets, traversing known high-risk jurisdictions ,overseen by a company with reported ties to the Wirecard scandal .

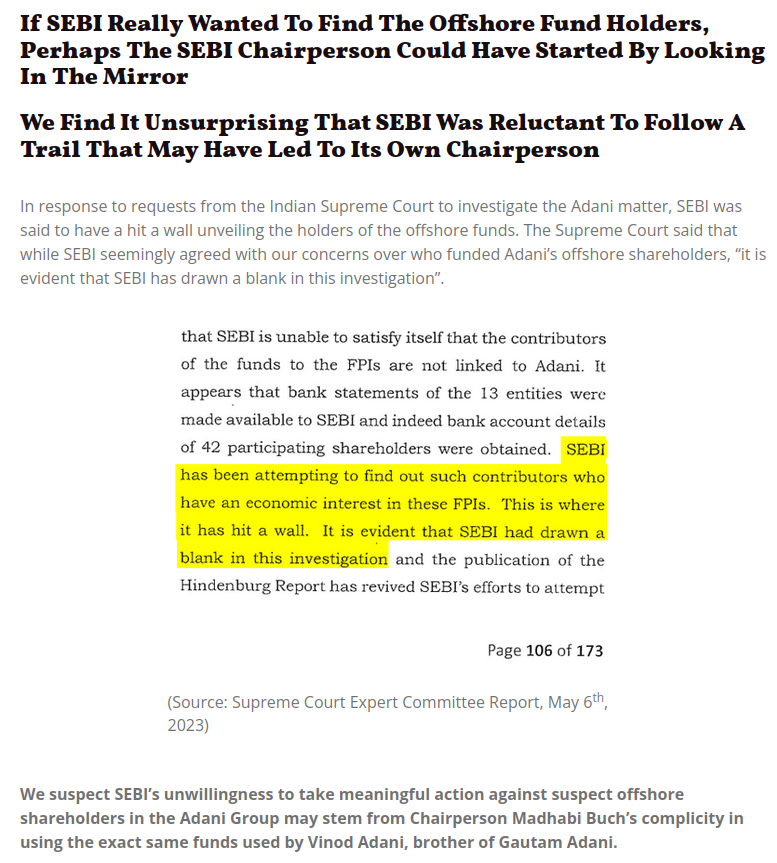

H’ble Supreme Court of India said that SEBI had , “Drawn by blank ” in its investigations into , “Who funded Adan’s offshore Shareholders “.

From April 2017 to March 2022 , she had 100% interest in an offshore Singaporean Consulting firm called Agora Partners .

On March 16th, 2022 , Two weeks after her appointment as SEBI chairperson , she transferred these shares to her husband.

During Madhavi’s tenure as a whole time member to SEBI , her husband was appointed as Senior Advisor to Blackstone in 2019. Blackstone has been one of the largest Investors and Sponsors of REITS , A nascent asset class in India.

During Dhaval Buch’s time as Senior Advisor at Black Stone , Blackstone sponsored Mindspace and Nexus Select Trust , India’s second and Fourth REIT to recieve SEBI approval to publicly IPO.

Also during chairperson’s husband tenure at Blackstone , SEBI proposed , approved and facilitated major REIT regulations changes. These changes include 7 Consultations papers , 3 Consolidated updates , 2 new regulatory frameworks and nomination rights for rights , which were profiting to private equity firms.

During industry conferences , chairperson has touted REIT as her , “favorite product for the future ” and also urged investors to look ” positively upon this asset class “.

Madahvi’s Agora Advisory

At the end of financial year 2022 , Agora Advisory (99% owned by madhavi) generated INR 19.8 million , which is 4.4 times her disclosed salary.

Conclusion

The alleged money siphoning scandal is a lot deeper than expected . Simultaneously we cannot expect everything from Hindenburg to be correct and accurate as it is a private international short selling based firm.

“Investors should remain calm and exercise due diligence before reacting to such reports. Investors may also like to take note of the disclaimer in the report that states that readers should assume that Hindenburg Research may have short positions in the securities covered in the report,” the SEBI said in a statement.